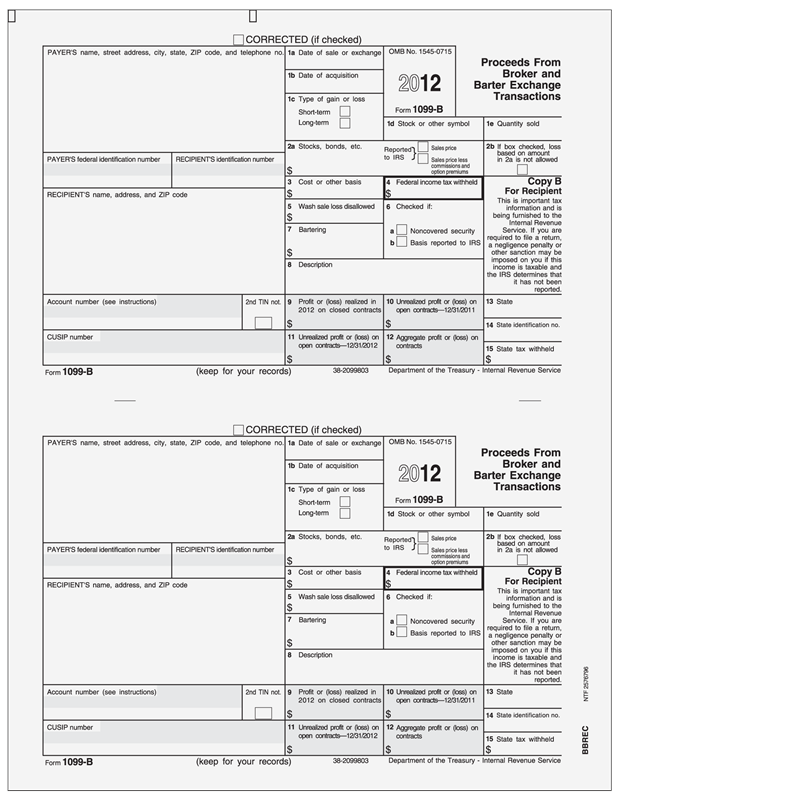

1099-b stock trade id

If you enter "0" as the cost basis, you will owe tax on the entire amount of proceeds long-term capital gain. If you can make a good-faith estimate on what was paid for the securities you sold, it will lower your tax on the proceeds.

You can research this online. One option is the Yahoo Finance website at: If you know when the stock was purchased, here are some tips:. People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses. Here are five guidelines:. Saved to your computer.

Select a file to attach: Ask your question to the community. Most questions get a response in about a day. After you register or sign in, we'll return you to this page so you can continue your participation in the community.

Submit a question Check notifications Sign in to TurboTax AnswerXchange or. Back to search results.

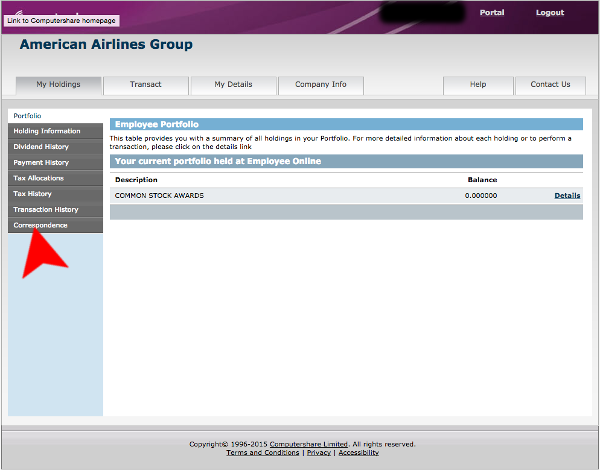

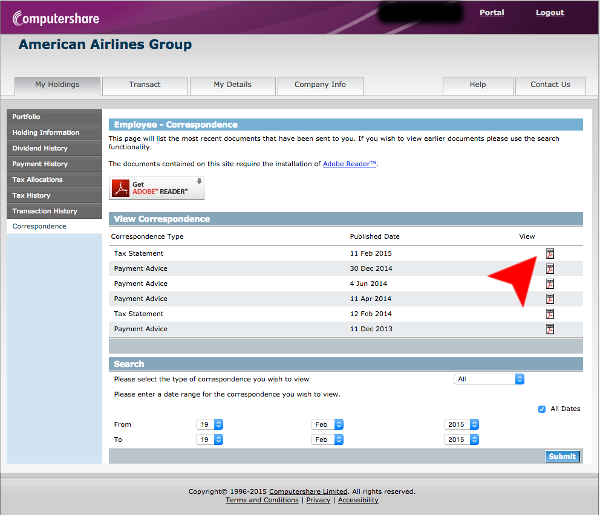

I cashed out a small account I have had since I was a child and the amount of 1, Recommended Answer 1 person found this helpful If you enter "0" as the cost basis, you will owe tax on the entire amount of proceeds long-term capital gain. This article provides additional information that might be helpful: If you know when the stock was purchased, here are some tips: If your current broker was the selling agent, there is usually a wealth of documentation available in your online brokerage account that can help, such as detailed reports on each sale.

Look at previous broker statements Review your records for the trade confirmation when you bought the shares. It's always a good idea to save these for tax purposes. If you purchased the stock at different times, or haven't sold all the shares at once, you may have more than one trade confirmation statement.

SECURITIES TRADER

If not, they might still be able and willing to look up the historical stock price for you. It's generally acceptable to take the lowest and highest price from a given day and average them to arrive at a cost.

on b form my cost basis is blank, what should I put? I cash - TurboTax Support

These free services may not include events that affect basis, such as reinvested dividends, spin-offs and stock splits. Or you can call the company's shareholder services department for help.

For shares purchased more than 10 years ago, go to a public library or law school library and look for back issues of newspapers, such as USA Today, to find the high and low price on the date of purchase. How do I find a stock's cost basis if I don't know when it was purchased? What is the cost basis of inherited stock?

How do I determine the cost basis of stock I received as a gift? Was this answer helpful?

Reporting Multiple Stock Trades On Schedule D | H&R Block®

TurboTaxToddL , CPA, MBA, MTax. No answers have been posted. This post has been closed and is not open for comments or answers. Here are five guidelines: When answering questions, write like you speak. Imagine you're explaining something to a trusted friend, using simple, everyday language. Avoid jargon and technical terms when possible. When no other word will do, explain technical terms in plain English. Be clear and state the answer right up front. Ask yourself what specific information the person really needs and then provide it.

Stick to the topic and avoid unnecessary details. Break information down into a numbered or bulleted list and highlight the most important details in bold. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. A wall of text can look intimidating and many won't read it, so break it up. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link.

Be a good listener. When people post very general questions, take a second to try to understand what they're really looking for. Then, provide a response that guides them to the best possible outcome.

Be encouraging and positive. Look for ways to eliminate uncertainty by anticipating people's concerns. Make it apparent that we really like helping them achieve positive outcomes.

To continue your participation in TurboTax AnswerXchange: Sign in or Create an account.