Sharpe ratio put option

Calculating sharpe ratio for shares is a straight forward task: However i remain baffled as to how to tackle the task for options, can someone please advise regarding this? How can i do the same with options? Would i need to go through a similar procedure of going back a date and doing step 1 again?

Sharpe Ratio Problem [Archive] - Actuarial Outpost

It seems to me that you want to use the series of option prices to estimate the Sharpe ratio given the option prices in your sample. So, basically if you have the option prices you just compute the return as if you would close the position at that time.

This way you obtain the evolution of the returns from which you get your average return R.

I guess this is some kind of homework and you are not working with real money because the method above is not that sound. Anyway, I hope this helps. I guess it makes more general approach and calculate the Sharpe ratio on the portfolio level. Of course, if you want you could take a portfolio with only one option to get your answer. I don't think that really makes sense because of the dependence of the returns of different assets.

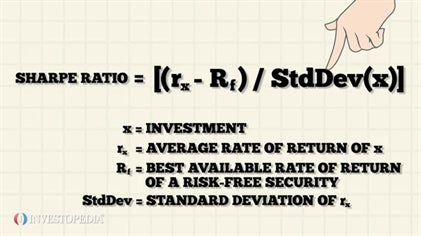

In this general approach calculation is easy, for the ex post Sharpe ratio we have: Now, I think in practice most people just take the realized returns and the formula and plug them in and thats that. Then, divide by the price to get the distribution of returns, calculate mean and standard deviation and plug this into the sharpe ratio sharpe ratio put option.

I simply priced the options based on the volatility,strike price, issue date, expiration date the greeks using a binomial price engine and then calculated the returns based around this. By posting your answer, you agree to the privacy policy and terms of service.

By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges.

12. Delta and Options PricingQuestions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The forex money management strategies pdf answers are voted up and rise to the top.

Conversely sharpe ratio put option shares such as aapl i can calculate weekly returns and easily calculate the average returns and standard deviation from these, for example if the following were aapl weekly returns: As long as you realize returns on any asset then you can calculate a risk adjusted measure of return, in your case Sharpe Ratio.

Options- Is There Money to Be Made Investing in Options a Historical Perspective | Sharpe Ratio | Option (Finance)

You can calculate the value of your portfolio on a daily or hourly basis. These values you can use to obtain returns.

Your edit makes your question even more confusing: Same with the proceeds you receive upon selling the delivered shares at market price. Also, you should read up on the basics of risk adjusted return measures. You need to generate a string of returns before you can calculate the variation of such returns.

So, I still do not understand what you try to achieve here???

I now think this question does not fit in our format and acted accordingly. KAT 1 5. This method is a LOT more complicated so the question is "is it worth it?

The problem with historical option returns is, that they are not even close to being iid Sign up or log in StackExchange. Sign up using Facebook.

Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers.

Quantitative Finance Stack Exchange works best with JavaScript enabled.

2 Option Writing Strategies Historically Outperforming The S&P | Seeking Alpha

There is no difference whatsoever. I simply priced the options based on the volatility,strike price, issue date, expiration date the greeks using a binomial price engine and then calculated the returns based around this share improve this answer. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.