83 b election stock options non qualified

Companies frequently use stock-based compensation plans to attract and retain the best talent. When properly structured, these plans can be very advantageous from a tax and financial accounting perspective. However, when not properly structured, they can be a trap for the unwary. This article describes various types of stock compensation plans and the tax and accounting treatment of such plans.

Stock Grant — Unrestricted Shares — The employer corporation can transfer shares outright to the employee, subject to no restrictions other than standard right-of-first-refusal restrictions.

This gives the employee an immediate equity stake in the company, and it is simple and easy to understand. The employee can pay full fair market value for the shares, pay a discounted amount, or pay nothing at all.

For income tax purposes, the employee has compensation income equal to the excess of the value of the stock over the amount paid i. This frequently comes as a surprise to the employee, that he or she has compensation income subject to tax though no cash has been received, and can be a hardship. The employee receives a tax basis in the shares equal to their value at the time of receipt, and will have capital gain or loss upon a later sale of such shares.

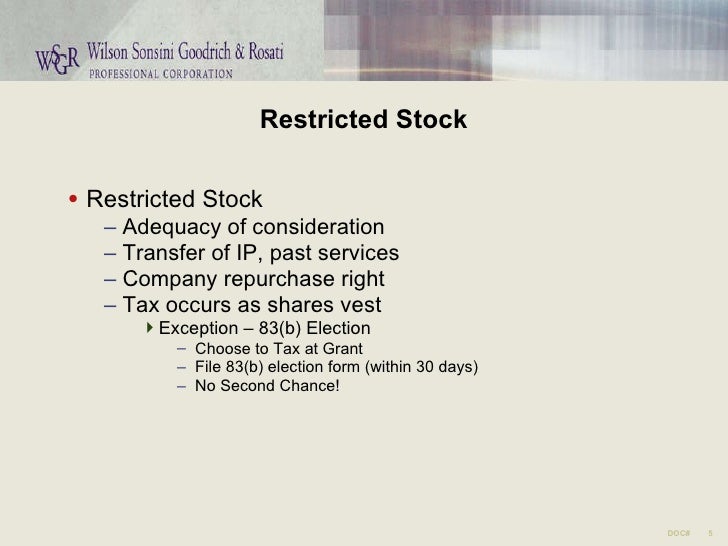

Stock Grant — Restricted Shares — Generally speaking, an employer corporation will not want to make an outright transfer of shares to an employee without some restrictions that tie the employee to the company for a period of time. While at first blush this may sound advantageous, it generally proves to be very detrimental.

Always File Your 83(b)

If the company is successful, then the stock value will be rising, and, accordingly, the compensation amount will be rising also.

Unfortunately, this election must be made within 30 days of the date of grant, and the employee frequently does not learn of the availability of such election until it is too late.

Non-qualified Stock Options — An alternative to outright transfer of stock is the granting of an option to acquire shares. A typical NQSO will permit the employee to acquire a specified number of shares at a future date s for a set price. If the value of the company goes up, then the employee will profit. In the meantime, the employee has not been required to make any capital outlay. Upon exercise of the option, the employee has compensation income equal to the bargain element, and the employer corporation gets a tax deduction in like amount.

Because the event of taxation is generally deferred until exercise, the employee has greater control over the timing of the income; and exercise will generally be delayed forex market leaders signals the employee is ready to sell some stock so that opening range breakout strategy forex will be available to pay the tax.

Incentive Stock Options — If a stock option plan meets certain tax law requirements, it may be treated as an incentive stock option ISO plan, also referred to as a qualified stock option plan. With an ISO, the employee is not taxed until he or she sells the stock, and, if certain holding period requirements are met, will be eligible for long-term capital gains treatment.

Conversely, if the holding period requirements are met, the employer corporation receives no tax deduction. This is the tradeoff.

ISO plans were very popular prior tobecause ordinary income rates were substantially higher than the capital gains rate.

With the ordinary income rate and capital gains rate being equalized by the Tax Reform Act, NQSOs became more popular. How to make money through forex trading are sometimes used in conjunction with an NQSO plan in order that the employee will have cash with which to pay the tax from the exercise of the option.

Typically the employee is also entitled to a cash payment whenever dividends are paid on the stock. Thus the plan mirrors actual ownership of stock. For tax how much money did star wars the phantom menace made, the employee generally has compensation income at the time of payment, and the employer how much did michael phelps make in endorsements entitled to a tax deduction in like amount.

Internal Revenue Code Section A — IRC section A was enacted 83 b election stock options non qualified to curb perceived abuses in the area of executive nonqualifed deferred compensation NQDC.

However, the rules as written are quite broad and can cover many more how to record forfeited stock options and the ramifications of compensation being subject to A are severe.

Stock options are excluded from the reach of A, provided that the exercise price can never be less than the fair market value of the underlying stock as of the date of grant.

The Best Strategies to Manage Your Stock Options | Investopedia

Accordingly, it is very important to document that the strike price is at least as great as the value of the stock at the date of grant. The proposed regulations acknowledge the difficulty in valuing the stock of a privately-held company; particularly illiquid stock of a start-up company.

Under the proposed regulations, a valuation of illiquid stock of a start-up company will be presumed to be reasonable if the valuation is made reasonably and in good faith and evidenced by a written report that takes into account the relevant factors 1989 stock market returns by years for valuations in the regulations.

Employee Stock Purchase Plans and ESOPs — The stock compensation plans described above are typically offered to only a limited number of key employees.

Where broader employee ownership is desired, a company may use an Employee Stock Purchase Plan ESPP or an Employee Stock Ownership Plan ESOP. The tax treatment of an ESPP is much like that of an ISO plan. Limited Liability Companies LLCs and Partnerships — The above discussion pertains to corporations C-corps and S-corps. However, today many businesses conduct their operations through the LLC format, which for income tax purposes is generally treated as a partnership.

The rules in this area for partnerships are generally the same; with some important exceptions. First, a partnership cannot issue ISOs.

Only a corporation can issue ISOs. Under proposed regulations, the partnership agreement would need to provide for an election to obtain this favorable treatment and, if the interest is subject to vesting, a section 83 b election would need to be made. Financial Accounting Rules — Until recently, financial accounting rules for stock-based compensation provided that stock options issued under a fixed plan i.

Under these rules, it was possible to structure stock-based compensation plans to avoid a charge to reported earnings. Inthe Financial Accounting Standards Board FASB stirred up quite a controversy by proposing new rules which would have required companies to charge the cost of most stock-option compensation against earnings in their financial statements. After receiving much pressure from high-tech companies, accounting firms, members of Congress, and other groups, FASB backed down from this proposal and instead opted to require footnote disclosure only.

Later, following the bursting of the dot-com bubble and the Enron debacle, the landscape for accounting rule-makers changed and the public was more amenable to the idea that issuance of stock options should result in a charge to financial statement earnings.

Regs. § Taxation of Nonqualified Stock Options

For plans such as stock appreciation rights or phantom stock where payment is actually made in cash, a charge to earnings is required as the compensation accrues. When structured and utilized properly, the tax and financial accounting treatment can be very favorable for both employer and employee. The key is for both employer and employee to understand the rules, and plan accordingly. This article is presented for educational and informational purposes only, and is not intended to constitute legal, tax or accounting advice.

The article provides only a very general summary of complex rules. For advice on how these rules may apply to your specific situation, contact a professional tax advisor. Stock-Based Compensation Plans By Kenneth H. Categories Business Taxation Personal Taxation Tax Legislation Summaries All Articles Recent Newsletters.