Exit options for private equity investors

It is the ultimate objective of all private equity investors to realize the return on their investment after a certain amount of time, typically between three to seven years after the original transaction took place. Performing an exit is the process by which private equity firms achieve such goal, which is therefore a natural part of the life-cycle of every private equity transaction.

Also, the number of successful exits achieved by a certain private equity house has a strong influence on its ability to attract investors and raise funds.

Private Equity --> ???? Exit Opportunities | Wall Stree

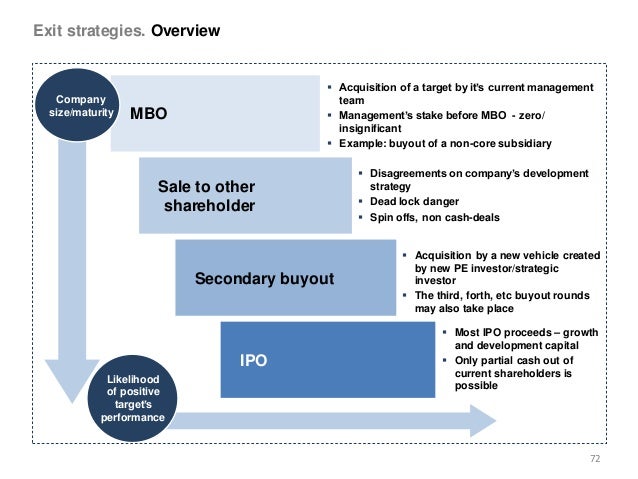

This is the reason why exits receive such special attention from the earliest stages of the deal. Generally speaking, several methods are available to private equity investors to exit their investment.

The most important and widely used exits routes are to be shortly analyzed below.

This is one of the most popular exit strategies used by private equity providers, due to the fact that when the proper market conditions are available, this method is likely to enable the investor to realize the highest return on its investment. Notwithstanding the higher outcome that can be obtained, IPOs also have serious disadvantages compared to other exit methods that need to be taken into consideration.

First of all, the public offering of shares in itself does not mean an exit.

The private equity provider will only be able to exit its investment when its shares are actually sold on the stock market, which is very unlikely to happen simultaneously with the IPO. Therefore, the investor seeking to perform an exit will be exposed to fluctuations and other market risks for a certain amount of time after the IPO is carried out.

Also, the listing of the shares of a company is typically subject to strict regulatory requirements and restrictions, which make the IPO a lengthy and expensive process. Another commonly used exit route is the trade sale in which the private equity investor sells all of its shares held in a company to a trade buyer, i. This method is preferred by private equity providers mainly because it provides a complete and immediate exit from the investment. Another advantage of the trade sale is that in this case, the negotiations take place with a single buyer which allows for a quicker and more efficient process which is not subject to the regulatory restrictions applicable to IPO transactions.

In a trade sale transaction, the investor can also exercise more control over the whole process, and in certain cases might even end up obtaining a higher value for the company compared to other exit methods.

On the other hand, trade sale is not free from potential problems and risks either. A trade sale might also entail serious business risks as the buyer is oftentimes a competitor of the company, which will inevitably obtain confidential business information during the negotiation process.

In the case of a secondary buyout, the company is sold by a private equity investor to another private equity firm.

In other words, the particular nature of a secondary buyout lies in that private equity houses appear on both sides of the deal, while in the average transaction private equity investors would only be involved either as seller or purchaser.

There are a number of possible reasons why an investor may choose this method as the exit route.

Private Equity Exit Options - Wazzeer

It can be a means of shortening the life-time of a transaction which has become a priority for private equity houses in the recent economic climate, and therefore secondary buyouts have become increasingly popular. Sometimes, the investor which carried out the original acquisition is not willing to or cannot finance a business anymore, even though the company might not yet be ready for a trade sale or IPO. In that case, selling the company to another private equity firm which sees potential in further developing the company might be a reasonable solution.

This method can also be used by the management when they wish to replace the private equity investor backing the company. A secondary buyout offers the advantages of an immediate and complete exit and it can be carried out even faster than a trade sale or an IPO. This plays a significant role in its increasing popularity.

Leveraged recapitalization is a partial exit method, whereby the private equity investor is able to extract cash from a business without actually selling the company.

This is achieved by re-leveraging the company i. The most important advantages generally associated with leveraged recapitalizations are that investors can remain in control whilst still receiving payment and the possible tax benefits compared to other types of exits.

On the other hand there are significant disadvantages to this method too. A leveraged recapitalization may result in over-leverage that can eventually lead to financial difficulties and even bankruptcy. Hungarian Private Equity and Venture Capital Association.

Private Equity What is Private Equity? PE explained Success stories Video selection Venture capital Glossary Library Links. Exit Routes in Private Equity Transactions Back. HVCA 11 Pauler Street Budapest, H Phone: Facebook Twitter LinkedIn RSS YouTube. Terms and Conditions Contact us.