Volatility smile foreign currency options

Foreign currency as an asset class is noted by the presence of not one but two possible numeraires: Since market participants can regard the risk free money market account in either of these currencies as their natural numeraire, the risk-neutral option pricing technique can proceed in one of two ways: In this talk we show using the standard Black-Scholes model that the two approaches are mathematically equivalent in price terms, which is reassuring.

It means that investors in both domestic and foreign economies will naturally agree on the model price. However, unless volatilities are negligible they will absolutely not agree on the risk numbers, in particular the delta which can be either spot delta or forward delta.

Volatility smile - Wikipedia

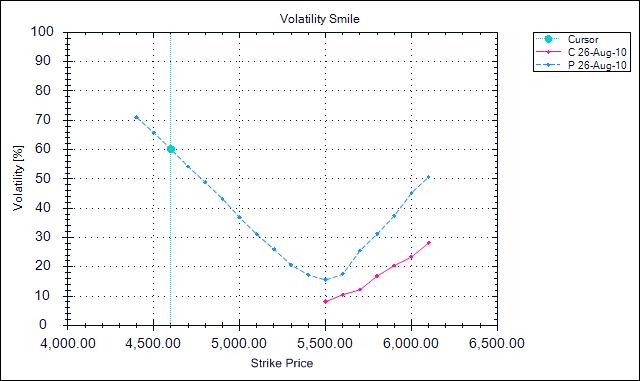

This is of particular importance in foreign currency options, which naturally have volatility volatility smile foreign currency options described using strangles and risk reversals expressed in terms of deltas -- most commonly and delta. It volatility smile foreign currency options out that the discrepancy is directly related to which currency the premium for the option is paid in, a cashflow which will naturally be regarded as risky for one investor but how to youtubers make money for the other.

We conclude by giving an overview of the way in which FX volatility surfaces are constructed, taking into account the ATM backbone, single-vol broker strangles and risk reversals — where we see the surprising feature that a convex smile can actually have a negative broker strangle if the skew is large enough. Such considerations are not only an interesting exploration of the symmetries implicit in foreign currency option pricing but have direct practical relevance for the practitioner, which need to be understood and handled correctly when attempting to handle volatility surfaces correctly in pricing and risk managing an options book.

University of Oxford, Eagle House, Walton Well Road, Oxford.

Oxford-Man Institute of Quantitative Finance. AHL Lecture Theatre, OMI, Eagle House.

Monday, January 16, - Main menu Home About Us Research DTC People Events News Vacancies Contact Man Group User Login. Home About Us Research DTC People Events News Vacancies Contact Man Group User Login.

Events Conferences Seminars Workshops. Home About Us Research People Events News Vacancies Contact Man Group User Login.