How to trade channeling stocks

Trading Channeling stocks is one of the most reliable and accurate trading techniques that provides traders with precise entry and exit points as well as stop-losses and take-profit recommendations. Channeling stock is a stock that moves up and down in repeated waves between two parallel lines. A lower line is called a support trendline and an upper line is called a resistance trendline. A support trendline connects the series of lows and the resistance trendline connects the highs.

The area between these two lines is referred to as a price channel or channel. We need at least 4 dots 2 lows and 2 highs to draw the price channel.

The more times the price touches and rebounds from the support and resistance lines without penetration, the more significant and reliable the channel becomes.

Channeling Stock | kysiqubonypun.web.fc2.com

There are three types of price channels: The Price channeling stocks strategy offers several different efficient techniques for each type of channels. The most effective way of trading channel is to trade in the direction of the channel, going long at rising channel and shorting the falling channel.

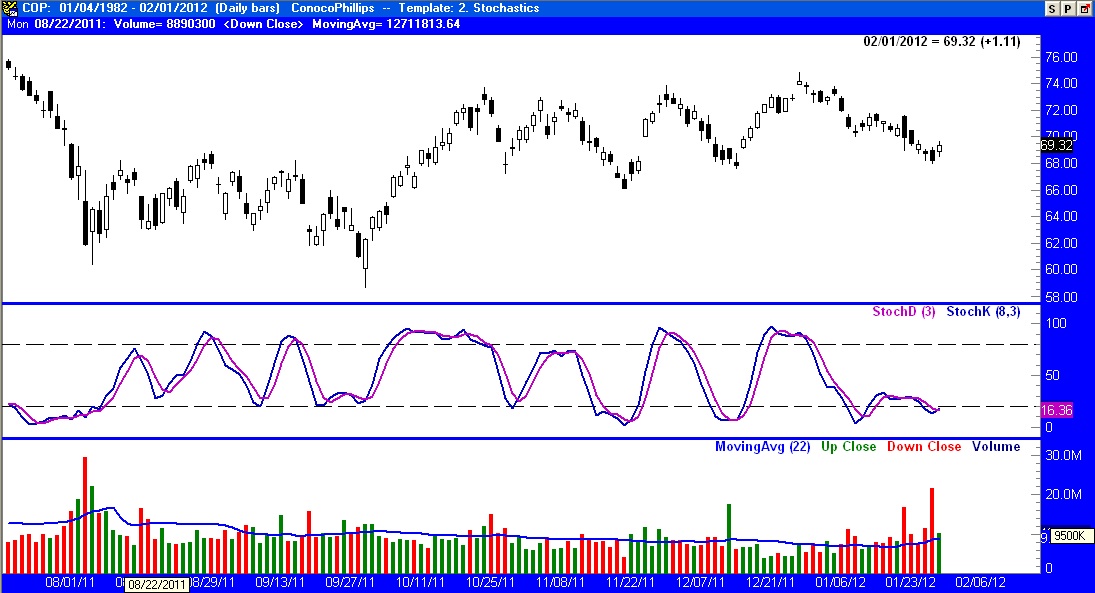

There are following basic rules of channel trading: Following is a real life example of how you can profit by using this simple technique. Let's look at the chart of QQQQ for the period from the January We can easily locate two relative highs: Now we are able to draw two trend lines: These lines being near parallel give us a perfect channel. Following our basic trading rules: QQQQ - Long-Term Trend There are several ways to locate the channeling stocks. You can manually look through charts or utilize the pattern recognition services.

The following links provide you with the list of channeling stocks and ETFs. Rising channel Falling channel. To narrow your search, you can use an advanced technical analysis filter to find a list of channeling stocks and ETFs with prices testing the support or resistance lines. For example, use the following links to find a list of equities with rising channel pattern with price near support level and equities with falling channel near resistance.

Rising Channel Support Falling Channel Resistance. In addition to the basic trading rules, a channeling technique provides risk management in form of stop-loss rules: If you enter a long position at a channel support level, set a moving stop-loss slightly below the support line. If you open a short position at a channel resistance level, set a moving stop-loss slightly above the resistance line.

There are additional trading rules and techniques that can help you to improve performance and reduce the risk in case of the channel breakout, false breakout and the channel narrowing.

Breakouts appear when the price breaks through the support or resistance lines. You can tight protected stop-loss order to limit your risk.

Some traders use the price channel breakout as a trend reversal confirmation to open a new position in the direction of the new trend.

In example with QQQQ above, if a trader opens a long position at channel support When a price breaks the support line and a stop order is executed, a trader can also enter a short position to profit from the price channel breakdown.

While a channel breakout terminates the current price channel,a false breakout appears when a price just pierces the channel trendline and then moves back into the channel area. Usually a false breakout scares traders out of the stock and makes breakout traders enter the wrong position.

In opposite to the false breakout, channel narrowing appears when the price drifts inside the price channel area without touching the support or resistance trendlines. In this case the narrower channel could be considered or other techniques can be used to enhance the accuracy.

There are several techniques you can use in conjunction with channeling to help verifying the channel strength, recognizing the price reversal and predicting breakouts. Candlestick patterns can be useful to confirm the price reversal or a channel breakout.

Trading Channeling Stocks

Analyzing chart trends in several different time frames can also help you accurately determine the price reversal and a channel breakout. The sub waves in the direction of a major trend have a five-waves impulse structure, while sub waves in the opposite direction have corrective three-wave zigzag structure. Using Elliot Wave analysis with channeling stocks can provide a valuable trading strategy for an experienced trader. Channeling works the best for short and medium-term trading with ETFs and medium volatility stocks.

Channeling stocks provides one of the most accurate and reliable market timing techniques, especially when it is used in conjunction with other technical indicators. Use if you want.

Channeling: Charting A Path To Success

Rising channel Falling channel To narrow your search, you can use an advanced technical analysis filter to find a list of channeling stocks and ETFs with prices testing the support or resistance lines. Rising Channel Support Falling Channel Resistance In addition to the basic trading rules, a channeling technique provides risk management in form of stop-loss rules: This work is available under the terms of the Creative Commons Attribution-NoDerivs 2. Please note that TheGreedyTrader Yahoo group is moved to the new TrendTrader Yahoo group.

QQQQ - Long-Term Trend. There are several ways to locate the channeling stocks. Technical indicators and trend parameters are calculated for the close of business day indicated on the top right corner of the screen.