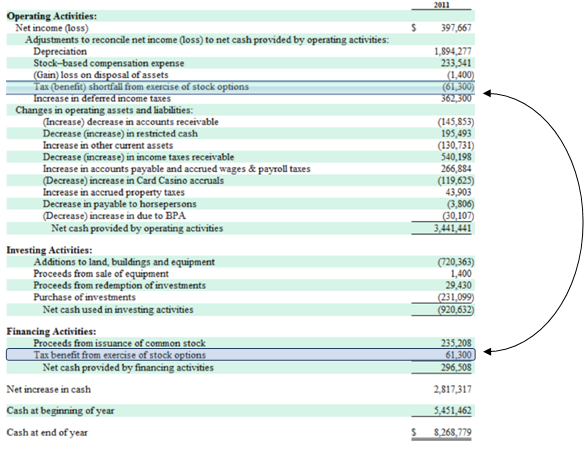

Stock option expense cash flow statement

Accounting for Stock Based Compensation Expense. Because this transition method was selected, results of prior periods have not been restated.

Cost of goods sold.

Hughes Optioneering

Selling, general and administrative expenses. Reduction of net income. Reduction of earnings per share: Table of Contents CHARLOTTE RUSSE HOLDING, INC. Stock Based Compensation continued.

Stock-Based Compensation in a DCFThe Company recognized the following stock based compensation expense for its stock option and employee stock purchase plans during fiscal Table of Contents The following table illustrates the effect on net income and net income per share if the Company had applied the fair value recognition provisions of SFAS R to share based compensation using the Black-Scholes valuation model with straight-line amortization of the expense over the respective vesting periods of the awards: Net income, as reported.

Share based compensation expense determined under fair value method, net of income taxes. Net income, including share based compensation expense. Prior to the beginning of fiscal , the Company presented the benefit of all tax deductions resulting from stock based compensation plans as operating cash flows in the Statements of Cash Flows. From the makers of. Charlotte Russe Holding CHIC.

BALANCE INCOME CASH FLOW. This excerpt taken from the CHIC Q filed Jan 26, The Company recognized the following stock based compensation expense for its stock option and employee stock purchase plans as follows: This excerpt taken from the CHIC K filed Dec 13, F Table of Contents The following table illustrates the effect on net income and net income per share if the Company had applied the fair value recognition provisions of SFAS R to share based compensation using the Black-Scholes valuation model with straight-line amortization of the expense over the respective vesting periods of the awards: EXCERPTS ON THIS PAGE: RELATED TOPICS for CHIC: Recent Accounting Pronouncements Stock Purchase Plan Calculation Fair Value Stock Options Interim Financial Statements VIEW MORE.

Track your investments automatically. Use of this site is subject to express Terms of Service , Privacy Policy , and Disclaimer.

By continuing past this page, you agree to abide by these terms. Any information provided by Wikinvest, including but not limited to company data, competitors, business analysis, market share, sales revenues and other operating metrics, earnings call analysis, conference call transcripts, industry information, or price targets should not be construed as research, trading tips or recommendations, or investment advice and is provided with no warrants as to its accuracy.

Stock market data, including US and International equity symbols, stock quotes, share prices, earnings ratios, and other fundamental data is provided by data partners. Stock market quotes delayed at least 15 minutes for NASDAQ, 20 mins for NYSE and AMEX.

Market data by Xignite. See data providers for more details. Company names, products, services and branding cited herein may be trademarks or registered trademarks of their respective owners.

The use of trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, is sponsored by, endorses, or is endorsed by Wikinvest. About Blog Press Feedback Help Get involved. Technology Energy Media Finance Green Issues China All Concepts. Metals Energy Meats Grains Softs.

For the Last Time: Stock Options Are an Expense

Currencies Geographies Exchanges Rates. How To Invest Personal Finance Options Definitions. Jan 26, K. Dec 13, RELATED TOPICS for CHIC: