Option pricing when underlying stock returns are discontinuous

Papers/Merton- Option Pricing when Underlying Stock Returns are kysiqubonypun.web.fc2.com at master · emintham/Papers · GitHub

Publication A-Z index Browse by subject Join Us Submit Manuscript Login. Science and Education An Open Access and Academic Publisher.

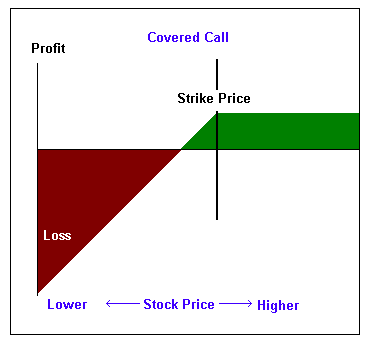

Blending Scenarios into Real Options: Relevance of the Pay-off Method to Management Investment Decisions G Favato 1 , , J A Cottingham 2 , N Isachenkova 2. This paper aims to demonstrate the relevance of the pay-off method to making management investment decisions under uncertainty. The success of the pay-off method as a replacement for the currently used option pricing algorithms was demonstrated by informing thirteen option pricing models with the same basic inputs and by comparing the mean option price obtained with the pay-off value.

Everything else equal, the pay-off method demonstrated to be a useful tool to management uncertainty due to its mathematical simplicity and the possibility to embed scenario planning into the real option valuation.

These benefits should make the use of real option thinking more relevant to management investment decisions under uncertainty. Pages Home About Us Journals Conferences Special Issues.

Partners Google Scholar CrossRef IBAAS VIRAL HEPATITIS CONGRESS JournalTOCs.