Investment options for nri in india 2015

Indian government promotes investment in India from abroad. Lots of NRI investment options are available that supports this cause. Indian nationals who are residing in USA, Europe, Australia etc like to invest in India. They get advantage of weaker Indian rupee compared to the currency of their residing nation. There are NRI in USA, Europe, Australia who are very successful. But the amount of profit that they can transfer back to their residing nation is controlled.

In repatriation basis, profits can be transferred back to foreign country. In non-repatriation basis profits cannot be back to their foreign country. Repatriation rules are different for different investment options. Before NRIs invests in India they must make sure that they are aware of repatriation rules.

Its is essential for NRI to open a bank account in India before investing. These securities issued by government of India. Hence they are very safe. Dated government securities are good for medium to long term holding periods. The interest that bears on these securities can be either fixed or floating.

Few types of dated government securities are as follows:. It easy for NRI to buy government securities in India. On basis of simple advicce from NRI, banks can buy and sell government securities on behalf of NRI. The same banks will also credit interest earned on these governemt securities in NRI account.

Bonds issued by Indian Public Sector companies can also be purchased by NRI. Here suitable investment horizon is 1 year. T-Bills are issued by government India from center. T-Bills are very safe investment option.

T-Bills pays no interest. But when they are issued, they are issued at a discount to face value. During redemption face value is paid to the investor. Minimum investment amount in T-Bill is Rs 25, Investors can invest in T-Bills in multiple of Rs 25, T-Bills can be purchased by participating in auctions organized by RBI. Auction participation can be done online in www.

A Resident Indian can buy T-Bills by opening Constituent SGL account with a Bank. Here government securities without any paper work.

They shall contact their Indian bank for effecting the purchase. The can also use other methods of buying mutual fund units like online purchases. After reading the offer document, NRI should fill an application form. NRI can also be bought directly from issuers website. Most issuer provide direct debit facility. Hence payment may not involve cheque and DD at all.

It is a point worth noting that Indian Mutual Fund Houses are not allowed to accept funds from NRI in foreign currency.

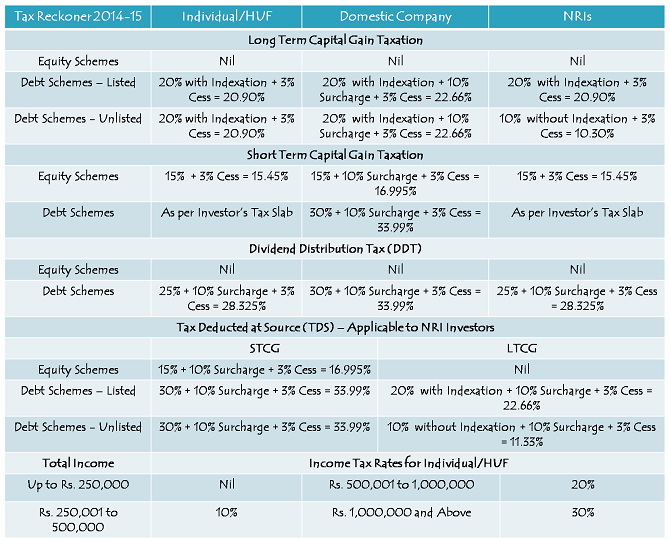

Hence investment by NRI, in mutual funds, can be made only in INR. Tax payable by NRI for Investing in Mutual Funds: These bonds are also considered as very safe investment options. Ministry of Finance gives permission to PSU to issue bonds to public. NRI are allowed to buy these bonds. Almost all nationalized banks have got permission to provide PIS services to NRIs.

After ones PIS is approved, NRI can purchase and sell stocks from secondary market. Not only shares but debentures, non-convertible debentures, equity linked mutual funds can be purchased under PIS scheme. Under PIS scheme, IPO shares and bonus shares are not covered. An NRI cannot do day-trading in India. They can only sell their shares after completion of 2 days of holding period.

Before investing in Indian stocks, NRI must know what is paid-up capital. Knowing this define the limit upto which a NRI can invest in a company. Paid up capital can be obtained by looking at companies balance sheet. Suppose paid-up capital of a company XYZ is Rs Crore. In this example, NRI can buy stocks of market price less than Rs 15 crore. Some banks charge very nominal fees but they do profit sharing. Companies raise funds by issuing debentures to public.

Some debentures can be converted into shares after maturity. They cannot be converted into shares upon maturity. NRI is allowed to buy NCD of Indian companies.

Top 7 investment options for NRIs to get high returns in India - kysiqubonypun.web.fc2.com

Debentures that can be converted into shares upon maturity are called convertible debentures. NRI are allowed to buy convertible debentures of Indian companies. Perpetual bonds are like normal bonds but it is without fixed maturity. Hence it can never be redeemed. So how investors make money by perpetual bonds? Companies pay fixed interest to the holder of such bonds. Institutions like Government, banks etc who require funds for very long time issues perpetual bonds.

Tax Liability of NRI investing in Stocks in India: These investments are very safe but give very low returns. Invested money from here cannot be repatriated to foreign country. The bank, on behalf of NRI, must apply to RBI in form ISD, seeking permission for investment in money market mutual funds. It is a formality that must be taken care by banks. NRI must simply inform their bank of their intentions with details and balance will be taken care from India. But they cannot buy agricultural land or a farm house.

Payment cannot be made in foreign currency. In times of euphoria like after BJP government formation in , real estate sector boom to new highs.

Should NRI file Income Tax returns in India ? | Wealthcom

Real estate sector has always been favorite of NRIs. They invest in project-launch stage and within 3 years they book profits. They cannot take away profit to their residing country. If payment for property is made using FCNR account, then money equal to paid amount from FCNR can be repatriated. If payment is made through NRE account then case is different. Balance money should stay in NRE account.

The transaction from NRO account is different. Companies must first confirm the investment limit from RBI before accepting funds from NRI. Details of deposits received from NRI should be disclosed to RBI. This is in responsibility of company and not of NRI. We need 6 to 8 million usd. Pay back max 2 to 3 yrs. Expect comm prod in 12 mo. Promoted by us citizen having pio card. Company already listed on bse. We need your advice and guidance on completing the project.

Start Here Products Podcasts Top Stocks Guest Post Ask Feedback. Hot Topics June 21, Student loan is tough to get? Ways to pay for college… June 13, Know about stock market investing… June 8, Common Income Tax Return Filing Mistakes To Avoid May 28, How Do We Cut Budget?

May 22, Biggest problems in investing money Search for: NRI Investment Options Posted By: We will speak it for you…. I really appreciate your time. If you can also put your comments or subscribe us below, it will be an excellent feedback for us. Please also consider sharing posts of getmoneyrich on facebook or twitter I am a Blogger with a passion for investment education. I started blogging in The idea with which I started blogging still stands true.

In my starting days my finances remained tight. I was reading heavily about how to manage finance. One day I got hold of a book which my father gifted me in It was stacked below my graduation books. It was a small-thin book with its cover named "Rich Dad Poor Dad" Leave a comment Cancel reply Your email address will not be published. Scholarly About PE Ratio of Stock About Stock Market Home Loan Prepayment. Top Posts Best Stocks to Buy in India for long term in Low Priced Stocks to Buy in India in Fastest Growing Companies in India in Debt Free Companies in India Best Dividend Paying Stocks in India.

Home Loan Prepayment Calculator Guide. Editors Choice… First Home Paycheck to Paycheck Rich Getting Richer Become Wealthy. New Posts Student loan is tough to get? Ways to pay for college… Know about stock market investing… Common Income Tax Return Filing Mistakes To Avoid How Do We Cut Budget?

Suggested Read Best investment Buy stocks online Not able to payback loan? Pay home loan early Pay yourself first. Appreciated Blogs Buy stocks of overseas company Gold or silver, which is better? How to use credit card Reasons of home loan rejection Stop spending on these things. Liked Posts How to reduce loan EMI? Mutual fund guide Prepare for retirement Tough goals needs risky investment What decides the strength of currency? NRI can keep their income generated in India like dividend, rental income, gift etc.

NRI can use FCNR to keep fixed deposits in foreign currency for max period of 5 years.