Stock split market value

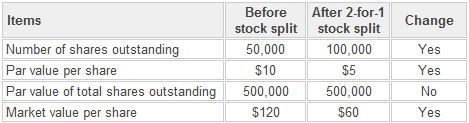

All publicly-traded companies have a set number of shares that are outstanding on the stock market. A stock split is a decision by the company's board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders.

For example, in a 2-for-1 stock split, an additional share is given for each share held by a shareholder. So, if a company had 10 million shares outstanding before the split, it will have 20 million shares outstanding after a 2-for-1 split.

A stock's price is also affected by a stock split. After a split, the stock price will be reduced since the number of shares outstanding has increased. In the example of a 2-for-1 split, the share price will be halved. Thus, although the number of outstanding shares and the price change, the market capitalization remains constant. A stock split is usually done by companies that have seen their share price increase to levels that are either too high or are beyond the price levels of similar companies in their sector.

The primary motive is to make shares seem more affordable to small investors even though the underlying value of the company has not changed. A stock split can also result in a stock price increase following the decrease immediately after the split. Since many small investors think the stock is now more affordable and buy the stock, they end up boosting demand and drive up prices.

Another reason for the price increase is that a stock split provides a signal to the market that the company's share price has been increasing and people assume this growth will continue in the future, and again, lift demand and prices. In JuneApple Inc.

AAPL split its shares 7-for-1 to make it more accessible to a larger number of investors. Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1, shares of AAPL pre-split will have 7, shares post-split. Another version of a stock split is the reverse split. This procedure is typically used by companies with low share prices that would like to increase these prices to either gain more respectability in the market or to prevent the company from being delisted many stock exchanges will delist stocks if they fall below a certain price per share.

In Mayin an effort to reduce its share volatility and discourage speculator trading, Citigroup C reversed split its shares 1-for While the split reduced the number of its shares outstanding from 29 billion to 2.

The bottom line is a stock split is used primarily by companies that have seen their share prices increase substantially and although the number of outstanding shares increases a european call option gives the buyer the right to ________ price per share decreases, the market capitalization and the value of the stock split market value does forex t12100 change.

As stock split market value result, stock splits help make shares more affordable to small investors and provides greater marketability and liquidity in the market. For more information on stock splits, see our article on Understanding Stock Splits.

Stock Splits: A Closer Look At Its Effects | Investopedia

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Understanding Stock Splits

What is a stock split? Why do stocks split? By Investopedia Staff Updated April 4, — 7: Learn why stock splits do not occur very often for individual stocks, and understand the impact of reverse stock splits on Learn about mutual fund share splits and why they occur, including how splits and reverse splits affect share price and total Learn why some companies decide to split their shares, and understand how they think it helps the stock's liquidity and future If a company splits its stock, there will be no gapping of the stock due to the split itself.

A stock split does not materially We explain what they are, the thinking behind them as well as their results. Warren Buffett's Berkshire Hathaway recently split its stock. Is this a sign to buy? Most trades, including short sales and options, aren't materially affected by a stock split. Still, it's important for shareholders to understand how these events impact various aspects of investing.

Stock Split

Be a savvy investor - learn how corporate actions affect you as a shareholder. Here are a few examples. Since stock splits decrease the stock price, do they also increase volatility because shares are traded in smaller increments? Investopedia examines assumptions about this increasingly common If stock splits and buybacks have been a bit of a mystery to you, you're not alone.

Learn some great tips. A modification made to a security's price that takes into consideration One of two ways to effect a stock split. In a push out, new share A method a business may use to pay its employees who are on international Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.