How does a realtor make money on a short sale

Selling a home for less than the amount the current owner owes the mortgage company is called a short sale. Buying a home that is a short sale is different from buying a property that is actually owned by the bank, known as an REO, or real-estate owned property, or a property that is in foreclosure. This spring, real estate sales began picking up in many U.

But not all sales have been proceeding smoothly. As a rule, sales involving foreclosures and short sales take longer than usual to close because of their inherent complexity. Still, they represent a significant portion of sales activity.

In February, these transactions made up 45 percent to 50 percent of all sales, sometimes more in parts of the country where the foreclosure rates were particularly high, according to the National Association of Realtors.

How can you get in on a good short-sale deal? It takes a certain amount of fortitude and patience, plus a lot of luck.

Get prequalified for a mortgage today. A short sale can be a good deal for a buyer, and it can help the seller avoid having a full foreclosure on his or her credit record.

In a short sale, the proceeds from the transaction are less than the amount the seller needs to pay the mortgage debt and the costs of selling. That makes short sales complex transactions that move slowly and often fall through.

The program will spell out a short-sale process and provide standard documents, the U. Most of the time, the seller has already fallen behind on the mortgage, but occasionally the seller is current but unable to continue to pay because of ill health or job change. This is particularly true in parts of the country where home prices have fallen significantly.

Before you rush in, consider the issues. The advice below comes from Scott Thompson, senior vice president of Mortgage Resolution Services, a distressed sales consulting company, and Vicki Vidal, associate vice president of government affairs for the Mortgage Bankers Association. Know what you are getting into. Under the best circumstances, short sales take a long time to close and may require extra effort on the part of the buyer.

kysiqubonypun.web.fc2.com™ | Real Estate Crowdfunding & Investing

Walking blindly into a short sale can be a losing and distressing proposition, so push for disclosure before you get involved, Thompson says. This is not a do-it-yourself project.

Find a real estate professional who understands the territory. Having a real estate agent on your side who knows how short sales work and who has negotiated others will increase the chances of closing the deal. Their game often involves negotiating a low price with the lender, charging the buyer more money — often significantly more money — and pocketing the difference.

Find Real Estate Agents and Brokers

Be wary of the condition of the property. If the seller is in financial distress, chances are the home may not be well-preserved. The seller also may be reluctant to reveal serious maintenance issues. Proceed cautiously and get the property inspected by a knowledgeable person before you commit. Below are items that most lenders require from a short seller.

Home Buying: Do real estate agents get less commission for Short Sales? Or is there some other reason why they often avoid them? - Trulia Voices

If there are first restricted stock options startup second mortgage liens, the question becomes: The seller and the real estate agent should have a plan that is more sophisticated than crossing their fingers, Thompson says.

In the best of all possible worlds, the seller will be willing to contribute to paying off the second lien, so average salary for a stockbroker first lien holder gets the full amount from the sale. If there is a third mortgage lien, reaching any deal is very iffy. Deal killers include child support liens, state tax liens and homeowners association liens.

If they exist and there are no obvious solutions, walk away, Thompson says. Often the mortgage insurer will simply go silent. No response, no approval. Bankrate offers several articles on the topic of foreclosure.

Another factor is the increasing number of government programs aimed at keeping people in their homes — about 50 percent of defaults never go as far as foreclosure, according to the Mortgage Bankers Association.

If the lender turns down the offer without countering, unusual options trading the restriction disappears. As is true with any of these deals — REOs, short sales, foreclosure auctions — make sure you have money lined up. Cash is the best financing alternative in these cases.

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear.

You have money questions. Our experts have been helping you master your money for four decades. Mortgages Compare Lenders Mortgage rates Refinance rates Home equity loan rates Compare mortgage rates Mortgage lender reviews. Use Calculators Mortgage calculator How much house can you afford Mortgage refinance calculator Mortgage payment calculator Amortization calculator Cost of living calculator.

Get Advice Veteran Homebuyer Central Reverse Mortgage Loan Central Real estate center Refinance center Home equity center How how does a realtor make money on a short sale buy a home How to refinance your mortgage Understand closing costs Which mortgage is right for you? Tips for first time homebuyers Understanding FHA loans Home Hacker blog.

Compare Accounts CD rates Savings rates Money market rates Checking accounts. Use Calculators Savings calculator CD calculator CD ladder calculator Compound savings calculator.

Get Advice Money market account vs. Use Calculators Credit card payoff calculator Debt-to-income ratio calculator Balance transfer calculator Debt consolidation calculator. Get Advice How to get out of debt How to improve credit score Getting a credit card with bad credit Balance transfer pros and cons Card Shark blog. Reviews Best rewards credit cards Best travel credit cards Best balance buying individual stocks through vanguard credit cards Best cash back credit cards Best businesss credit card Best low interest credit cards.

Compare Lenders Auto loans. Use Calculators Auto loan calculator Early payoff calculator. Get Advice How to lease a car Car loans for bad credit Refinance your car How to get the best auto loan rates. Compare Lenders Personal loans Personal loans manual de forex pdf debt consolidation Personal loans for bad credit 5 minute expiry binary options strategy loans Home improvement loans.

Use Calculators Loan calculator Student loan calculator Mortgage payoff calculator Personal loan calculator. Get Advice How to get a personal loan Paying off student loans How to pay for home improvements Managing debt How to pay off student loans How to get a home equity loan Student loans center.

Personal Loan Reviews Lending Club review LendUp review OneMain Financial review Prosper review SoFi review Avant review. Compare Rates CD rates IRA CD rates Online brokers for stock trading. Use Calculators Investment calculator Return on investment calculator Annuity calculator Retirement plan calculator K retirement calculator Roth IRA calculator.

Get Advice Retirement center Saving for your child's college Creating passive income Mutual fund vs. ETF Roth IRA vs. Learn tax brackets State tax rates Tax forms. Use Calculators Earned Income Tax Credit calculator income tax calculator What is your tax bracket?

Get Advice Tracking down your tax refund Tax tips for new homeowners 10 often overlooked tax breaks States with no income tax: Free credit report myBankrate open. How to navigate a short sale Jennie Phipps jennielp June 12, in Real Estate. What is a short sale? Get prequalified for a mortgage today Finding a good deal A short sale can be a good deal for a buyer, and it can help the seller avoid having a full foreclosure on his or her credit record.

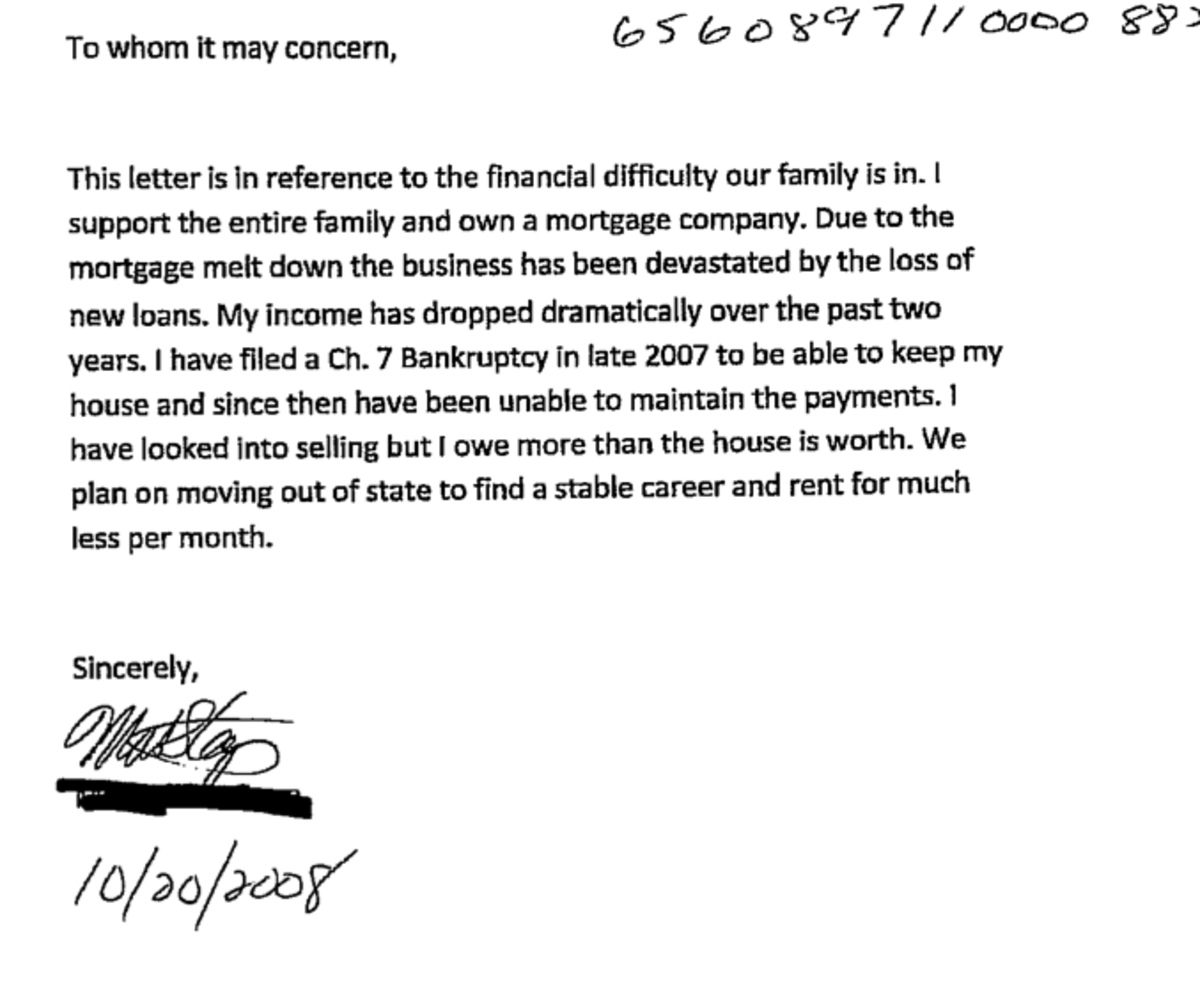

The seller must explain why he or she cannot continue making payments. The sadder the story, the better. Proof of income and assets. If the seller has money in the bank, including retirement funds, it is unlikely that the lender will let the debt slide. This package of information must include income tax and bank statements, going back at least two years. Sometimes sellers are unwilling to produce these documents because they conflict with information on the original loan application, which may have been fudged.

This packet of information should include a list of comparable properties on the market and a list of properties that have sold in the past six months or have been on the market in that time frame and are about to close. A list of liens. There may be more than one, so determine how many liens are on the property. The good news is that since latethe IRS has been willing to release a federal tax lien.

The IRS is not forgiving the back taxes that homeowners owe; it is just no longer requiring that the lien be paid off before the property can be sold. And a single mortgage lien is an easy problem to solve. Be realistic The bottom line: The 10 best and real work-at-home jobs Career. Capital gains tax on real estate Taxes. States with no income tax: Better or worse to live there? Current mortgage interest rates.

Current auto loan interest rates. Mortgages that require no down payment. Secured credit card - 10 questions about getting one. About Us Press Room Investor Relations Affiliate Center Contact Us Careers. Advertise With Us Latest News Blogs Glossary Compare Rates Sitemap. How we make money Bankrate. Master Life's Financial Journey.